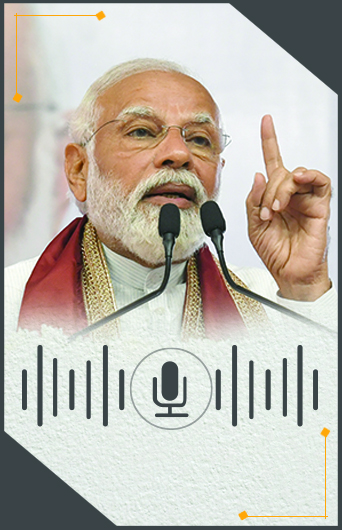

PM Modi – Major Announcement on GST Reforms and Key Updates from Red Fort on Independence Day 2025

On August 15, 2025, India celebrated its 79th Independence Day with Prime Minister Narendra Modi delivering a historic 103-minute address from the Red Fort in New Delhi. This speech, the longest Independence Day address of his tenure, outlined transformative initiatives aimed at shaping India’s socio-economic landscape. Among the most significant announcements was the introduction of next-generation Goods and Services Tax (GST) reforms, promised as a Diwali gift to the nation. This 2800-word article provides a comprehensive analysis of PM Modi’s GST reform announcement, other major updates from the Red Fort, and their potential impact, optimized for SEO to attract readers seeking detailed insights into this landmark event.

Introduction to the Independence Day Address

Independence Day 2025 marked a pivotal moment as PM Modi unfurled the national flag at the Red Fort, addressing the nation with a vision for a “samarth” (strong) India. The 103-minute speech, surpassing his previous records, captivated millions and set the stage for economic and social reforms. The highlight was the announcement of GST reforms, aimed at reducing tax burdens and boosting economic activity. This article explores the details of these reforms, contextualizes them within Modi’s broader agenda, and examines other key announcements, making it an essential read for policymakers, businesses, and citizens.

Background of GST in India

Introduced on July 1, 2017, the Goods and Services Tax (GST) unified India’s indirect tax system, replacing multiple central and state levies. Over eight years, it streamlined taxation but faced criticism for its multi-slab structure (0%, 5%, 12%, 18%, and 28%) and compliance complexities. PM Modi’s 2025 announcement signals a review, building on past simplifications like the removal of over 40,000 compliances and income tax overhauls. This context underscores the need for a “next-generation” GST regime, aligning with India’s economic evolution.

PM Modi’s Major Announcement on GST Reforms

The Diwali Gift Promise

During his Red Fort address, PM Modi declared, “This Diwali, I am going to give a great gift… We are set to introduce a ‘next-generation GST reform’,” framing it as a festive boon. He emphasized lower tax rates on daily-use items, aiming to ease the cost of living for the middle class and small businesses. The reforms are scheduled for implementation by Diwali 2025, leveraging the end of the GST compensation cess (extended to March 31, 2026) to create fiscal flexibility.

Key Features of the Reforms

The proposed GST overhaul, detailed through government statements and media reports, includes:

Structural Reforms: Addressing inverted duty structures (where input tax exceeds output tax), resolving classification disputes, and ensuring rate stability to boost business confidence.

Rate Rationalization: Reducing the number of slabs to two—5% and 18%—with a 40% special rate for sin goods (e.g., tobacco, online gaming). Approximately 99% of items in the 12% slab and 90% in the 28% slab are expected to shift to lower brackets.

Ease of Living: Simplifying registration, return filing, and refunds, with technology-driven processes to enhance compliance.

The Finance Ministry confirmed that a Group of Ministers (GoM), led by Bihar’s Deputy Chief Minister Samrat Chaudhary, will finalize details, with the GST Council likely meeting in September 2025 to approve the changes.

Economic Impact

Experts like Vivek Jalan of Tax Connect Advisory Services LLP predict that items of mass consumption will move to the 5% slab, lowering costs for households. The move is expected to boost consumption, offset revenue losses through higher compliance, and support MSMEs by reducing administrative burdens. PM Modi highlighted that cheaper goods would strengthen the economy, aligning with his “reform, perform, and transform” mantra.

Other Major Updates from the Red Fort

Beyond GST, PM Modi’s speech outlined several transformative initiatives:

Mission Sudarshan Chakra for National Security

Announcing “Mission Sudarshan Chakra,” a decade-long plan to fortify India’s borders by 2035, Modi cited recent security threats. This multi-agency initiative will leverage advanced surveillance and rapid-response units, with Union Home Minister Amit Shah praising its integrated approach. The mission also hints at reviewing the Indus Water Treaty, reflecting a firm stance against cross-border terrorism.

Urban Employment Scheme

A Rs. 1 lakh crore Rozgar Yojana was unveiled to address urban unemployment, targeting youth, graduates, and those impacted by automation. The Pradhan Mantri Viksit Bharat Rozgar Yojana offers Rs. 15,000 to first-time private sector employees (in two installments), aiming to support 3.5 crore youths over two years. Policy analysts hail this as a bold response to job market challenges.

High-Powered Demography Mission

To counter demographic imbalances from illegal migration, Modi introduced a data-driven mission to enhance border management and empower local authorities. This initiative aligns with his “Atmanirbhar Bharat” (Self-Reliant India) vision, emphasizing national security and social fabric preservation.

Tenfold Increase in Nuclear Energy

Modi pledged to increase India’s nuclear energy capacity tenfold by 2047, supporting the “Viksit Bharat” goal. This move, backed by international partnerships, aims to reduce carbon emissions and fossil fuel dependency, positioning India as a clean energy leader.

Additional Announcements

Agricultural Productivity: Enhanced support for farmers through climate adaptation funds.

Digital Infrastructure: Expansion of digital public infrastructure, including the Unified Payments Interface (UPI), which handles 50% of global real-time transactions.

Women’s Empowerment: Incentives for women entrepreneurs and recognition of “Nari Shakti” (women’s power) in sectors like defense and space.

Detailed Analysis of the GST Reforms

Current GST Structure

India’s GST operates with five slabs: 0% (essential items), 5% (21% of goods), 12% (19%), 18% (44%), and 28% (3%), plus special rates for precious metals. The proposed two-slab system (5% and 18%) aims to simplify this, with the 40% rate for demerit goods ensuring revenue stability. The end of the compensation cess, which added up to 290% on luxury items, provides fiscal space for these adjustments.

Implementation Timeline

The GST Council, last meeting in December 2024, is expected to convene in September 2025 to deliberate on the GoM’s recommendations. Implementation is targeted for October 2025, ahead of Diwali, with phased rollouts possible based on state consensus.

Stakeholder Reactions

Industry: FICCI’s Jyoti Vij hailed the reforms for benefiting consumers and MSMEs, while industry associations anticipate a post-pandemic economic boost.

States: Some opposition-ruled states express revenue concerns, though the Centre emphasizes cooperative federalism.

Public: Social media sentiment, reflected in posts on X, shows optimism about cheaper goods, though debates persist over revenue impacts.

Broader Economic and Social Context

Alignment with Modi’s Vision

The GST reforms and other announcements align with Modi’s 25-year governance experience, focusing on ease of living and doing business. The emphasis on self-reliance echoes his call for Swadeshi products, urging traders to promote local goods.

Global Perspective

With India negotiating free trade agreements with developed nations, the GST overhaul aims to eliminate barriers, enhancing global competitiveness. The nuclear energy push and digital infrastructure expansion further position India as a technological powerhouse.

Challenges and Criticisms

Revenue Implications

Reducing slabs may initially strain state revenues, with 70-75% of GST currently from the 18% slab (2023-24 data). The government expects higher compliance and consumption to offset this, but opposition states may resist without guarantees.

Implementation Hurdles

Consulting 28 states and finalizing 1,500 item classifications pose logistical challenges. Past attempts at rate rationalization, stalled since 2021, highlight the complexity of consensus-building.

Public Perception

While welcomed by many, some X posts question the feasibility of timely implementation, citing past delays. Critics also argue the reforms favor urban consumers over rural needs.

Detailed Timeline of Events

July 1, 2017: GST rollout.

December 2024: Last GST Council meeting.

August 15, 2025: PM Modi announces next-generation GST reforms and other initiatives.

September 2025: Expected GST Council meeting.

October 2025: Targeted implementation before Diwali.

Expert Insights

Economists like Anurag Kumar of Times Now note that the reforms could mark a turning point, provided execution matches intent. Tax experts suggest that simplifying slabs aligns with global best practices, though success hinges on state cooperation and public adoption.

Final Words

PM Modi’s Independence Day 2025 address from the Red Fort was a clarion call for a transformed India. The next-generation GST reforms, promising cheaper goods and economic growth, stand as a cornerstone of this vision, complemented by security, employment, and energy initiatives. As the nation awaits the GST Council’s decisions, these announcements signal a bold step toward a “Viksit Bharat” by 2047. Stay updated as developments unfold. You can visit the official website: https://www.pmindia.gov.in/en/

Frequently Asked Questions (FAQ)

1. What did PM Modi announce about GST on Independence Day 2025?

He promised next-generation GST reforms by Diwali 2025, with lower tax rates on daily-use items to benefit the common man and MSMEs.

2. When will the GST reforms be implemented?

The reforms are targeted for October 2025, pending GST Council approval in September 2025.

3. What are the new GST slabs?

The proposed structure includes 5% and 18% slabs, with a 40% rate for sin goods, replacing the current multi-slab system.

4. What other major updates were announced?

Mission Sudarshan Chakra, Rs. 1 lakh crore employment scheme, Demography Mission, and a tenfold nuclear energy increase by 2047.

5. How will the reforms impact the economy?

They aim to boost consumption, support MSMEs, and enhance ease of doing business, though revenue challenges remain.

You may also like to read: https://khabarkhabri.com/green-india-3024/